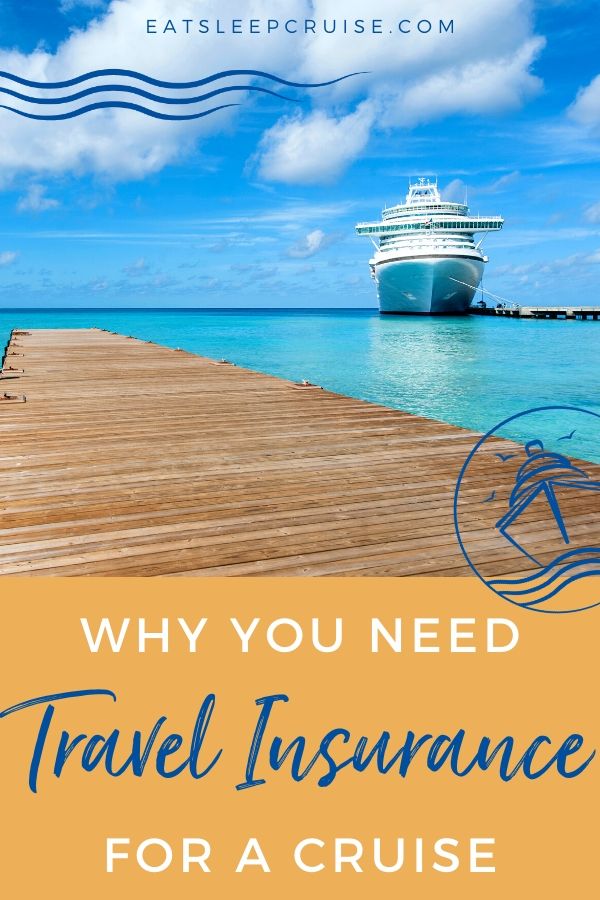

One of the most important — but often overlooked — things to check off your ‘to do’ list before you set sail on a cruise is to make sure your travels are covered in case of the unexpected. What if your flight is canceled and you miss the ship? What if your luggage is lost or damaged? What if you have a medical emergency while at sea or in a foreign port? These types of scenarios and more can be covered with travel insurance so you can be worry-free during your vacation. Here’s our guide to travel insurance for a cruise, including six reasons we highly recommend purchasing it.

What is travel insurance?

Travel insurance is exactly as the name suggests — insurance for unexpected delays, cancellations, luggage issues, medical issues, and more during a vacation. You can purchase it whether you’re taking a trip within your own country, or whether you’re traveling to foreign destinations. Though, it’s a more popular option for foreign travel specifically for the health coverage. While your usual health insurance should cover most domestic medical situations, most health insurance policies don’t cover medical expenses internationally. Travelers are also more likely to purchase travel insurance the more expensive and lengthy their trip is because there’s more to lose if something goes awry.

How much does travel insurance cost?

There is no one-size-fits-all cost when it comes to pretty much any insurance plan, and that goes for travel insurance as well. Factors like where you live, your age(s), and the length and cost of the trip all go into determining how much coverage will cost for your vacation. It also varies depending on the level of coverage you want to purchase and the specific insurance company you end up going with. However, for a rough estimate, you should plan to spend about five to 10 percent of your total trip cost on travel insurance.

Where can I purchase travel insurance for a cruise?

There are several avenues for where you can purchase travel insurance. Firstly, you may notice when you book your cruise that it offers you the option of adding on a travel insurance policy right through the cruise line. Airlines also offer flight-related coverage when you purchase your airfare. While these can be decent options, you’ll pretty much always get better coverage and a better price if you look elsewhere.

We recommend using an aggregate website like tripinsurance.com or insuremytrip.com, which allow you to compare plans from different companies to find one that suits your needs the best. Your travel agent might also offer you insurance through its insurance partner, which is another good option. Lastly, check to see what coverage your credit card offers. Many credit cards offer some travel coverages, and/or have the option to add on a travel insurance package through them for additional coverage.

When should I purchase travel insurance?

A good rule of thumb for determining when to purchase travel insurance is this: as soon as possible. Once you’ve made your initial deposit for your cruise and/or have made your other major arrangements for the trip, start looking into travel insurance options.

Some benefits of your coverage, such as cancel-for-any-reason coverage, can only be used later on if you purchase travel insurance within a certain timeframe after booking your trip (often within two to three weeks). There also may be a similar deadline for submitting a preexisting medical condition waiver for the health coverages in your insurance plan.

The only thing to keep in mind before purchasing insurance is to make sure you have a good idea of how much your trip will cost as far as major expenses like flights, hotels, and the cruise itself. This is because the cost of your insurance is, in part, determined by the cost of the trip. It also protects the full amount you paid for the trip. If you underestimate the cost of your vacation when purchasing insurance but then have to cancel unexpectedly, you won’t get the full amount back that you’re expecting from your travel insurance policy.

Top 6 Reasons to Purchase Travel Insurance for a Cruise

1. The unexpected happens before your cruise.

No one likes to cancel a cruise, especially for unforeseen circumstances. An illness, a loss of job, or other family emergencies could happen at any time. If these events do occur just prior to your cruise, you might be saying goodbye to most, if not all, of the funds you paid toward your cruise and possibly even your flights.

With the right travel insurance policy, you can rest assured that you will be refunded if one of these unfortunate events do occur. You will be able to focus on the urgent matters at hand without worrying about having to deal with the travel companies. Then, you can use the returned funds to book another trip when the time is right.

2. You don’t get to the ship on time.

Those early morning flights on the day of the cruise are a drag, to say the least. What were we thinking? Nowadays, we always fly the day before our cruise to ensure we are in the ship’s homeport on time. Even if you follow this advice, travel insurance can help when there are unforeseen circumstances like weather delays, flight cancellations, or issues getting to the port. If you have travel insurance, these hiccups will not keep you from getting on the ship. Your insurer will do what they can to get you on the ship as soon as possible, even if that means flying you to a port of call. Don’t ruin your vacation because you didn’t plan ahead.

3. Your bags are lost or damaged.

No one likes lost baggage during a trip. Calling the airlines, coordinating with agents, and dealing with other potential issues does not sound like a good way to spend a week of rest and relaxation. If issues with luggage should arise, your travel insurance company will be there to handle it instead. Depending on your plan, they might also include a stipend for you to get additional clothes and necessary items while they sort out the situation.

If your bags never turn up, the travel insurance company will provide compensation so you can restock your closet. Although, you might want to wait until you are home so your wardrobe isn’t filled with Hawaiian shirts!

4. You get sick (or injured) while on your voyage.

Accidents can happen, and other medical ailments can pop-up while you are traveling. Travel insurance will cover many of the medical expenses and costs associated with these emergencies. While you might not think about it, the cost for being seen in a foreign hospital can be quite hefty. If your condition is serious, the ship could leave you at the port. How will you get home? If something happens while at sea, you could be responsible for thousands of dollars in costs for medevac flights. Hopefully, you will never need medical attention while on a cruise, but if you do, having travel insurance for a cruise will ease your worries and the burden of any potential medical bills.

5. Something happens while in port.

You are having such a great time at Señor Frogs that you don’t realize the time. You turn to see your ship sailing away without you. Or, while at the local straw market, your wallet and passport are stolen. Travel insurance can help those who encounter such issues while they are off the ship. Most plans will cover costs to get you from the port to meet up with the ship at its next port of call. Many companies also offer 24-hour travel support services that can help you work with embassies and local agencies if you are missing vital documents and identification.

6. Travel insurance is cheaper than you think.

Perhaps the number one reason to get travel insurance for a cruise is the cost. It is much cheaper than you think. You can shop around to compare prices from numerous companies. The cruise lines offer their own coverage, as do many travel agents who work with insurance partners. If you are spending thousands of dollars for your family’s vacation, adding a few hundred dollars to ensure that your vacation is protected is well worth the cost.

Comments

Do you purchase travel insurance for your trips? Have you ever had to use the insurance for any unforeseen circumstances? Drop us an anchor below to let us know your experiences with using travel insurance for a cruise.

6 comments

Julie

Yes I purchase travel insurance. Was glad I did husband hurt his back and had to cancel the cruise. Called and they were very helpful

Adrienne

I used to not purchase travel insurance. My first cruise I didn’t. And other land trips I didn’t. Until 2014 we booked with a group from a sister the trip was to Isearal it was for 9 days. They said that they had travel insurance for the group. This was not the case or it was not very good. Our flight was delayed because of weather so we missed a day of the tour and the airline lost our luggage. We didn’t get money back for missing a day or lost luggage I was happy I packed change of clothes in my carry on. This is when I learned to buy travel insurance my self not trust that some has brought for the group.

I started purchasing travel insurance.

This past December 2017 I end up in the ER 3 weeks before my 9 day cruise. The Doctor hospitalized me said I probably need surgery for instantal blockage. 2 days later I had surgery to remove blockage. The surgery was pretty major and doctor would not allow me to go. It was to be an extended family vacation. My mother, and myself, my bother, his wife, and son. My cousin, her husband and son. My cousin didnot buy the travel insurance. Had to go on the trip without the rest of us. The rest of the family had trip insurance. We were able to all of our money back. It was the cruiseline insurance. Also my mother and myself had purchased the cruise with an cruise valchure as our deposit. We even got that back and have until 2020 to use it. However, when I purchase travel insurance I must make sure it covers a pre-existing condition because it could come back at anytime. But shouldn’t if I watch my diet. I will always buy the travel insurance. I am already planning two cruises.

DB

Thanks for the comment. Glad to hear you are doing well and had travel insurance to cover your missed trip. Everyone’s circumstances are different, so making sure to read all the fine print when comparing policies is import. Happy cruising.

Linda B

We always buy trip insurance and have successfully used it twice. It is worth every penny. The first time we were on a riverboat cruise on the Danube in December for the Christmas Markets. When we got to Vienna to go to the airport to fly home, we discovered that a terrible snowstorm 2 days before had closed Heathrow Airport which is where we were to go to catch our connecting flight. We ended up staying in Vienna for 2 extra days (that certainly was no hardship) and our trip insurance paid for our hotel, our meals, our taxis to the hotel and back to the airport and all change fees on the flights. The only thing it didn’t cover was $50 for one dinner where we splurged and went over the meal allowance and a little bit of airport parking when we got back. The second time we used our trip insurance was in 2016 when we had a 15 day Viking Ocean cruise booked through the Viking homelands. I was diagnosed with pneumonia 4 days before we were to leave. The trip insurance reimbursed us every penny of the cost of the whole trip. And I am excited that just yesterday we rebooked the same cruise for 2019 so we will get to see the Viking Homelands after all.

DB

Thanks Linda for the comment. Sounds like some exciting trips and glad to hear the travel insurance protected you guys on both instances. The Viking Homelands cruise sounds amazing. Happy cruising.